Let’s face it, if you’re a CPG brand and selling on Target, Amazon, and Walmart, you’re probably spending hundreds if not thousands of dollars per week on advertising.

Have you been told this is just how it works if you want to rank at the top of e-commerce search results?

We’re here to tell you that it’s not the only way. Brands can reach the top of search results, without breaking the bank. The gist is that it’s most important for CPG food brands to understand the difference between search and filter on e-commerce platforms. This includes major grocery retailers like Target, Walmart, Thrive, and Amazon, as well as wholesale platforms, like Faire.

Search vs Filter: What’s the Difference?

Search and filter are two essential features of online grocery retail, but they have different functions.

Search is a tool that allows customers to enter specific keywords or phrases to find products that match their search criteria. To rank high in organic search results, you need to focus on copy, assets, and advertising. There are a variety of aspects needed to optimize your search ranking. Brands that rank high for specific searches will have optimized the product’s keywords that align with those searches. This is a popular area with solutions from numerous data partners and agencies specializing in targeted advertising and optimized search rankings.

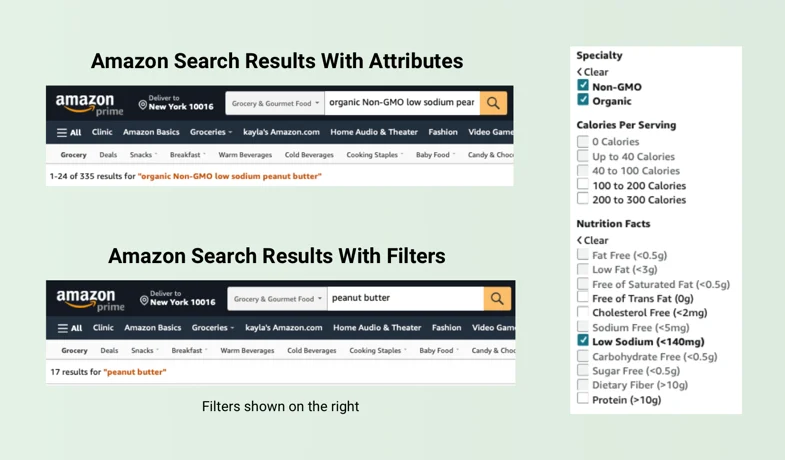

Unlike search, filters allow customers to narrow down their search results by selecting specific attributes; such as price, category, and dietary preferences. These filters are typically presented on a left-hand panel and can be selected in combination to refine a customer’s search further. Products that rank high when filters are selected have up-to-date and complete data, specifically accurate back-end attribution data that matches their qualified claims with the proper filters.

Putting Search and Filters to the Test

Let’s put our search versus filter difference to the test on two major U.S. online grocery retail platforms. We’ll start with a classic American staple; peanut butter. A conscious consumer is likely to have more specific preferences than a basic peanut butter. Popular attributes for the nut butter category include organic, Non-GMO, and low sodium, so we adjust our test search accordingly.

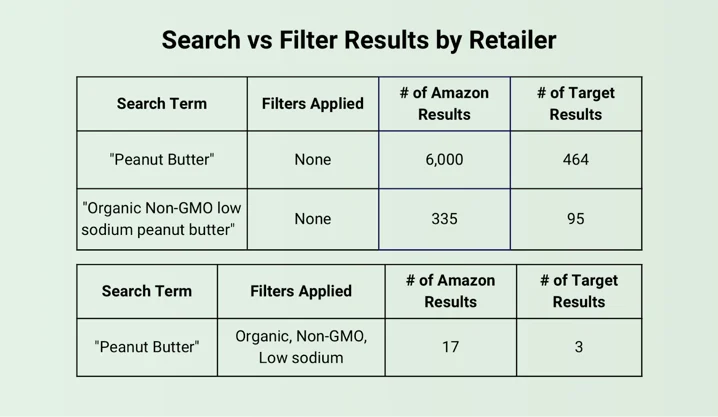

If a customer searches for “peanut butter” on Amazon’s Grocery and Gourmet category, they will receive 6,000 results. If they search for “Organic Non-GMO low sodium peanut butter” they will receive 335 results. In comparison, if a customer searches Amazon for “peanut butter” and then selects organic, Non-GMO, and low sodium filters their search results narrow down to just 17.

If a customer searches for “peanut butter” in Target’s Grocery category, they will receive 464 results. If they search for “Organic Non-GMO low sodium peanut butter” they will receive 95 results. In comparison, if a customer searches Target for “peanut butter” and then selects organic, Non-GMO, and low sodium filters their search results narrow down to just 3. Only 1 of those 3 products is actually peanut butter, the other 2 are peanut butter-flavored foods. Beyond our example attributes, Target offers customers the choice of 24 “Dietary Needs” filters for the Peanut Butter & Jelly subcategory alone.

Manual searches of both Amazon and Target reveal that plenty of other peanut butters sold on their platforms also qualify for the “organic” “Non-GMO”, and “low sodium” claims.

Because those brands left those back-end product attributes unclaimed, they missed a key opportunity for differentiation and discovery. Other search and filter audits of major retailers return similar results. It’s clear that optimizing product filter ranking is a widely missed opportunity.

Improving Attribution for Filtering: The Underserved Solution

While many service providers and resources in the e-commerce space focus heavily on improved search results, they often overlook the power of filters. Research shows that shopping using filters reduces a consumer’s uncertainty about a product matching their specific preferences. Improving back-end attribution for optimized results for filtering is an underserved solution.

The easy solution to differentiate your product in a crowded landscape lies in attribution. The more back-end attributes your product claims, the more likely it is to rank high in results when consumers select one, or even multiple, filters. Maximizing the number of back-end attributes your product claims can give you a more competitive edge, increase your visibility, and boost sales.

To summarize, understanding the distinct benefits of search and filter is crucial for the success of CPG food brands. Filter features are a common method of shopping used by consumers, especially conscious consumers who typically select multiple filters to match their very specific preferences. CPG food brands are missing the opportunity for discovery by consumers simply by leaving qualified product attributes unclaimed. Brands that optimize their product data with filters in mind can improve their discoverability, rank higher in search, and increase their chances of driving sales.

CPG food brands must maximize their online presence to be successful in the competitive world of online grocery retail. Working with a trusted data partner who can help you identify all of your product’s qualified attributes is a cost-effective solution to optimize your discoverability.

About EatQ

EatQ is a leading product data platform that specializes in helping small, health, and sustainability-focused brands differentiate themselves in online grocery retail. The EatQ platform provides affordable pre-sales planning, marketing, and research tools including Competitor Comparison and Claim Finder features.